Methodology

The OFEX methodology was developed based on the recommendations made by the expert members of the project’s Scientific Directory, the ILB Labs of Louis Bachelier Institute and the Center for Financial Studies.

Global approach

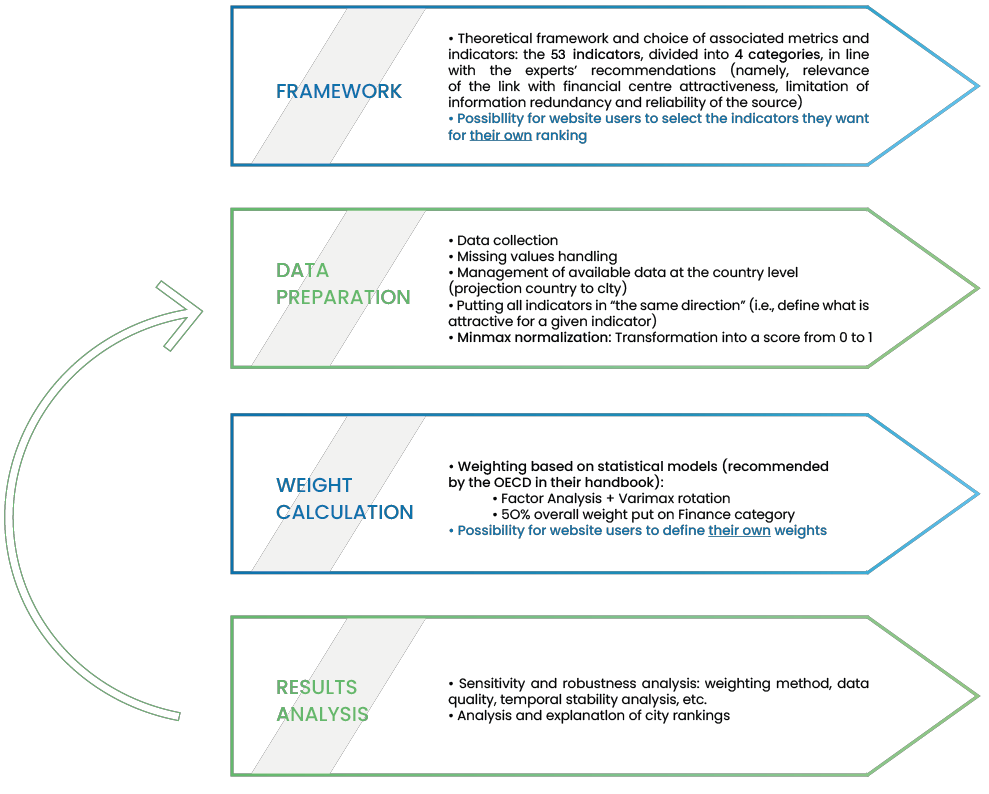

The ranking is based on statistical methods inspired by the OECD and especially their handbook ‘Handbook on constructing composite indicators’ that allows to:

- Accurately preprocess data

- Standardize data

- Calculate the weights of indicators and categories

The methods are transparent, interpretable, objective and scientifically sound. They allow us to reduce redundant information in the indicators and to identify precisely all the factors that play a role in the attractiveness of a financial centre.

All statistical choices were carefully thought, analysed, and challenged by experts to ensure that each step makes sense regarding the objective to build the most reliable index to measure attractiveness. For most of them, analysis of the sensitivity of the ranking towards different possible choices and simulation of the impact of each change on the ranking were analysed.

Although OFEX approach is based on statistical methods, there are some limitations:

- Firstly, the indicators and categories chosen play a central role in the ranking. That is why such tremendous care, effort and time have been put into indicators selection.

- Secondly, the data pre–processing steps also influence the ranking. Most notably, country to city data projection has been identified as a critical step. OFEX limits this step’s influence by restricting the number of countries with several financial centres ranked.

- Other potential limitations have been identified and analysed but have a lower impact, such as missing data handling or the imbalanced number of variables per category.

FINANCIAL CENTER PERIMETER

The OFEX methodology is used to calculate the ranking of financial centres’ attractiveness measured on 53 indicators divided into 4 categories.

The OFEX 2025 ranking compares 52 cities from 48 countries. This is more than several global financial centres analysis found during the literature review, as they usually focus on cities with the biggest volumes and are quite often limited to OECD countries.

The choice was made not to include cities/metropolises that could be considered as financial centres. The approach starts with a broad selection of financial centres based on available data. Then some financial centres were let aside when they could not be precisely ranked due to statistical reasons, notably when too much data was missing.

The starting point is an initial database of more than 100 financial centres. This list mostly results from their presence in selected indicators.

We then only select the financial centres that have:

- 50% or less missing values on all city level indicators (over all categories).

- 50% or less missing values on financial indicators at city level.

Justification is that we deem not to be able to properly rank a financial centre that would not meet these two criteria.

For countries that still have several financial centres after this step, another filter is implemented:

- If a financial centre is small in absolute terms AND in relative terms (compared to financial centres from the same country) then it is set aside.

This filter had to be added to limit the influence of country to city data projection that mostly impact countries with several financial centres. This filter is thus implemented before such projection.

That leads to ranking 52 financial centres for 2025.

This number may evolve between OFEX yearly publications, based on data availability, either increasing or decreasing.